Under the Affordable Care Act (ACA), there is a Premium Tax Credit (PTC) that helps eligible individuals and families lower their monthly insurance premiums. These credits are commonly referred to as “subsidies.”

“Enhanced” Premium Tax Credits (sometimes written eAPTC) refers to the version of the credit expanded under the American Rescue Plan Act (ARPA), which took effect for Marketplace plans beginning in 2021. These changes increased subsidy amounts and removed the 400% of Federal Poverty Level income cap.

These enhancements have been extended under subsequent legislation and are in effect through the 2025 plan year under current law.

But, unless Congress acts, these enhancements will expire after 2025, meaning many individuals may see much higher premiums. Some estimates are 100-150% higher than the current monthly cost.

The current government shutdown is mainly due to some members of Congress wanting to keep the eAPTC. We know that Congress listens to their voters first. You can use the link below to contact your representatives.

👉 Here is the APTC Resource Kit: APTC Kit for Consumers

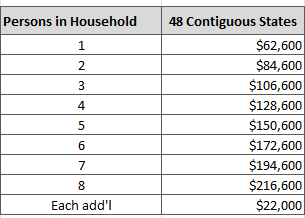

Will you be affected? Here are the income limits: